Advertisement

Giving to charity can be useful for supporting causes close to your heart and also getting the most out of your tax deductions. If you are a regular taxpayer or run a business, knowing how to incorporate donations into your tax plans could greatly change your financial circumstances. This article will direct you towards productive methods of giving charitably along with advice on taxes so that both, charitable aims as well as monetary objectives can be reached effectively.

If you give money to a recognized charity, these contributions can be seen as tax deductions. Tax authorities like the IRS usually accept donations made toward 501(c)(3) organizations, if and only if they are itemized in your tax documents. This indicates that instead of opting for a standard deduction, you have chosen specific deductible expenses including charitable giving which aims at reducing taxable income.

Please be aware, that the IRS has certain rules for donations to qualify as tax deductions. The donation should go to eligible charities and proper paperwork like receipts or bank records is needed as proof of your contribution. Knowing these fundamental regulations is a starting point in adding charitable contributions to your overall tax planning approach.

One of the starting choices in enhancing your tax reductions through donations to charity is if you should itemize your deductions or apply for the standard deduction. The standard deduction represents a set amount that lessens your taxable income and it's accessible to every taxpayer. If you often donate or make large contributions, then itemizing might give more considerable tax advantages.

Listing lets you to take away other costs in addition to gifts for charity like interest on the mortgage, healthcare bills, and state levies. But, your total deductions must pass over the limit of standard deduction so that listing becomes valuable. A lot of taxpayers find this helpful especially those with large donations towards charity because listing can lower their whole tax responsibility significantly.

A method to increase tax efficiency while doing charity can be achieved through donor-advised funds (DAdFs). DAF is a mode of charitable donation that lets you contribute to a fund, obtain an instant tax deduction, and then distribute the contributions to different charities as per your timing. This tactic could be very helpful for those who wish to enlarge their donations in one particular year without having urgency about deciding which charity they have support.

DAFs offer adaptability as they let the giver suggest grants to particular charities at a future date. When you contribute to a DAF, it offers the advantage of getting an immediate tax deduction but also enables you to take time to determine how the money should be distributed. This method can assist in steering your donations so that it is consistent with your extended-term strategy for tax planning.

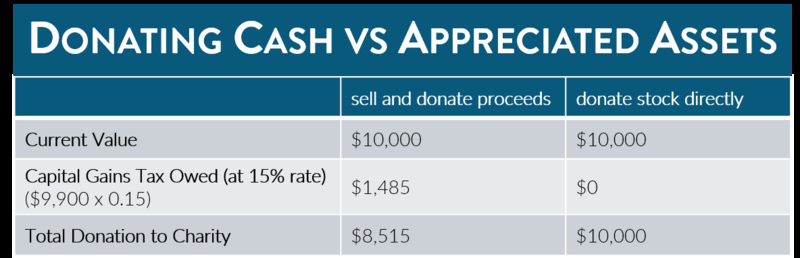

A good method to increase your contribution towards charity and simultaneously get optimal tax advantages is by giving appreciated assets like stocks, bonds, or real estate instead of cash. If you give these assets that have gone up in value, it lets you not pay capital gains tax on the increased worth and possibly claim a deduction depending on the total honest market cost of the asset.

For instance, suppose you bought shares for $1,000 and now they are worth $5,000. You have the option to give these stocks directly to a charitable organization and subtract the fair market value of $5,000 from your tax calculation even if your initial investment was only $1,000. Furthermore, you do not need to pay any capital gains tax on profit amounting to 4$4 thousand dollars which is an increase from the original buy price. This method of giving assets that gained value over time is frequently employed by people who made substantial investments or those who seek to reduce taxable earnings within a year.

For those who have their own business, the act of giving to charity can significantly help in planning for taxes. A business can donate towards charitable causes and claim these donations as a part of its expenses, provided that they are given to recognized charitable institutions. The common practice is that corporate donations become deducted as typical costs related to running a business. This signifies taking them away from taxable income which helps lessen total tax obligations overall.

Owners of businesses can also benefit from giving to charity through programs that match gifts given by employees. This increases the total amount donated and benefits workers who are encouraged to donate as well. These programs give businesses a way to share their charitable acts, which helps improve how they're viewed and draws in customers who appreciate when companies help society.

Charity donations can be a crucial part of planning your estate. Giving assets to charitable organizations may decrease the taxable amount of your estate, possibly reducing taxes after you die. By including donation plans in your estate preparation, you can make sure that what's left behind reflects your goals towards philanthropy and simultaneously lessens tax pressure on your property.

There are several methods for including charitable donations in planning your estate. You can consider setting up a charitable remainder trust as one such method. This way, you can donate assets and still earn income from them while you're alive. Once you pass away, whatever is left in this trust goes to the charity of your choice. This plan can give important tax reductions during your life and after you pass away while making sure that your charity aims are achieved.

At last, it is significant to have a discussion with a tax expert when you are devising tactics for charity donations. The rules concerning these gifts and deductions can be complicated due to tax laws, so guidance from a professional is beneficial in understanding the intricacies of such planning. A consultant on taxes ensures that all possible deductions are utilized fully by you, keen decisions about donation methods are made, and your charitable actions within your comprehensive financial strategy.

Besides the planning of your taxes, an expert can also guide you about how charitable donations work regarding your complete wealth management and intentions for estate planning. These professionals may give advice regarding which charity strategies match well with your financial conditions, assisting you in fulfilling both philanthropic desires and tax objectives. Collaboration with a tax specialist could eventually aid in enhancing the effects of your gifts to charity.

Giving to charity presents many chances for bettering your tax strategies while helping valuable causes. By cleverly making donations, like listing deductions, using donor-guided funds, giving appreciated assets, or including charitable gifts in estate and business plans, you can take full advantage of the tax positives from your kind acts. Speaking with a tax expert makes sure that you are making decisions wisely that fit both your money aims and good cause wishes. In the end, being mindful of donating to charity could result in substantial tax benefits. At the same time, it can contribute a long-term positive effect on society.

Advertisement

By Nancy Miller/Dec 12, 2024

By Paula Miller/Dec 07, 2024

By Isabella Moss/Dec 12, 2024

By Maurice Oliver/Dec 12, 2024

By Celia Kreitner/Sep 27, 2024

By Elva Flynn/Nov 03, 2024

By Elva Flynn/Nov 16, 2024

By Elva Flynn/Nov 13, 2024

By Isabella Moss/Oct 11, 2024

By Madison Evans/Oct 10, 2024

By Alison Perry/Oct 10, 2024

By Darnell Malan/Nov 05, 2024